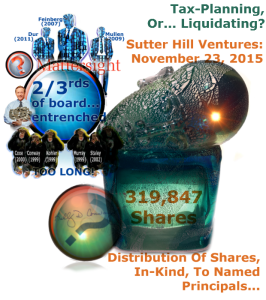

Well, at the outset, I will candidly admit (in fairness) that all of this may simply be year end window dressing/tax planning for the named partners — of the general partner, of Sutter Hill Ventures. You see, it COULD be that they need taxable capital losses, to offset other (tech start up investments’) capital gains, taken during 2015. Longer term, all of these shares of Mattersight should show capital losses. So — when distributed out in kind, these partners may elect to defer the loss, or take it in 2015, in a number of differing structures.

Well, at the outset, I will candidly admit (in fairness) that all of this may simply be year end window dressing/tax planning for the named partners — of the general partner, of Sutter Hill Ventures. You see, it COULD be that they need taxable capital losses, to offset other (tech start up investments’) capital gains, taken during 2015. Longer term, all of these shares of Mattersight should show capital losses. So — when distributed out in kind, these partners may elect to defer the loss, or take it in 2015, in a number of differing structures.

So it could be tax planning afoot. [Here is Sutter Hill Ventures’ twitter feed, just FYI.]

Careful investors may want to consider the OTHER possibility, as I say — i.e., that it could also be that some or all of them intend to sell their stakes as quietly as they can, under applicable SEC Schedule 13D rules. It is not clear whether these shares, now that they are distributed, must be voted in a block, or sold in a block, per some Sutter Hill instruction.

I strongly suspect they are free of any such restriction. I say this, because prior hereto, there was no need to have a control agreement, where SHV owned them directly. Now that they’ve been distributed, any control agreement should be filed as an exhibit to this amended Schedule 13D, under applicable SEC rules.

There is no exhibit. So — I think they are each free to sell, or pledge their shares.

We will keep an eye on all of this, but Mattersight has been off — albeit slightly — both yesterday and today, on the news.

Object lesson? Be careful out there. Lots of shares could show up for sale at any time in the next months — entirely aside from those we expect will be issued directly by Mattersight, soon.

Here’s the quote from the overnight Schedule 13D amendment:

…On November 19, 2015, in accordance with the terms of its limited partnership agreement, SHV distributed in kind, on a pro rata basis and for no additional consideration, an aggregate of 319,847 shares of the Issuer’s Common Stock and 96,261 shares of the Issuer’s Series B Preferred Stock to the managing directors of its General Partner, including the following Reporting Persons, who are also members of the management committee of the General Partner….

As a footnote, here is Mr. Coxe’s related SEC Form 4. Each of the other named persons has also filed a related Form 4 — but I’ll not link those here. They repeat this information, for each.

Only real, net buys or sells by long-time shareholders count. The number of shares issued is so large compared to daily volume that any major acquisition or divestiture of shares has to be managed outside the open market. Acquisition is the endgame, and if MATR wants to be acquired, their case would be better served if their model actually worked and with $40m in revenues they could actually show a real, unqualified, profit.