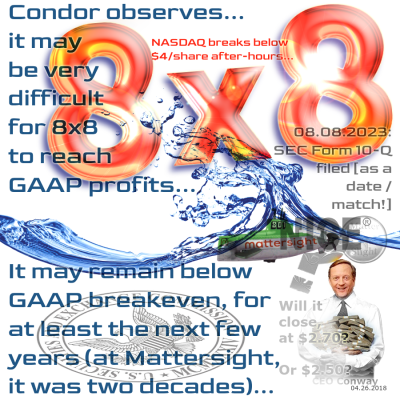

Well, not too terribly surprising, as 8X8 says it wants to emphasize profitable growth only — no chasing sales, just for sales’ sake — if the same won’t help it reach GAAP breakeven.

Well, not too terribly surprising, as 8X8 says it wants to emphasize profitable growth only — no chasing sales, just for sales’ sake — if the same won’t help it reach GAAP breakeven.

And that is wise.

But the reason this is unsurprising… is that we have argued for about a decade now [right here, on the old eLoyalty / Mattersight / now (sporadic) NICE review blog] that the entire sector is largely unable, globally… to charge a price for the services each of these companies provide… that would allow it to be profitable, consistently.

Said another way, the universe of buyers just doesn’t value a “CRM dashboard” as highly as these companies would hope. Despite all the chatter about AI enhancing this or that portion of the services and software delivered, it still remains a very labor intensive matter to install the suite of applications, and to keep them updated and running.

The entire sales cycle is much more like selling consulting services (a very long lead time to a “yes” and contract signing / checks being issued)… than shrink-wrapped software… let alone a streamed “download anywhere” — use everywhere (automated deployment).

This is true because these tools — at NICE or 8X8 (or previously at Mattersight) must be able to run on dozens of legacy business systems, some approaching two decades now in service (Windows Xp-, or earlier version Apple OS- based).

So — while the press release talks about “customer wins” — the fact is that revenue will keep shrinking, and true GAAP profitability is several years off, even if 8X8 continues to only take higher priced engagements. The base of unprofitable relationships, most long term, is just too large.

And to be fair, that is true at larger NICE as well. Here’s the SEC Form 10-Q and the most relevant bit, below — I’d expect 8X8’s NASDAQ price to decline, tomorrow. In fact, it has broken below $4 in after hours trading on the news.

…In the first quarter of fiscal 2024, our total revenue decreased $4.3 million, or approximately 2% year-over-year, to $183.3 million primarily due to a $3.9 million decrease in our service revenue….

NICE has the advantage of lower overall labor costs, with much of its customer support tele-help sourced out of Southeast Asia.

NICE has the advantage of lower overall labor costs, with much of its customer support tele-help sourced out of Southeast Asia.

That may be what 8X8 needs to take a serious look at re-tooling toward.

Onward — just a tough market to be in, world-wide. Out.